The Best Offer Types for Facebook and LinkedIn Campaigns

What did $42M in spend on Facebook and LinkedIn tell us about successful paid social ads?

A lot—but mainly, it showed us the four elements of paid social ads—the ad format, channel, audience and offer type—must work in harmony to drive leads, pipeline and ROI.

We know that’s easier said than done, so we put together our B2B Paid Social Benchmark Report to dive into the best CTAs for different campaign objectives, optimal copy length, whether you should use image or video ads, and much more.

This follow-up report looks specifically at offer types and gives you the scoop necessary to pick the right ones to optimize your demand generation strategy in 2023.

First, what’s an offer type?

Before we get into the data, let’s clear any clouds about what offer types are and, more importantly, what they are not.

In the simplest of terms, the offer is what your target audience gets in exchange for their click.

Offer types:

- Demo

- Webinar

- Event

- Other

Offer types are related to call-to-action (CTA) buttons, but they’re not the same.

CTAs are the buttons or links your target audience clicks when they’re interested in your offer. Common CTAs on LinkedIn and Facebook include Download, Learn More, Sign Up, and Register.

In the example below from monday.com, the CTA is Learn More, and the offer type is Demo.

Why? Monday.com is providing access to a demo. To get that demo, viewers have to click the CTA at the bottom of the ad and provide the required information.

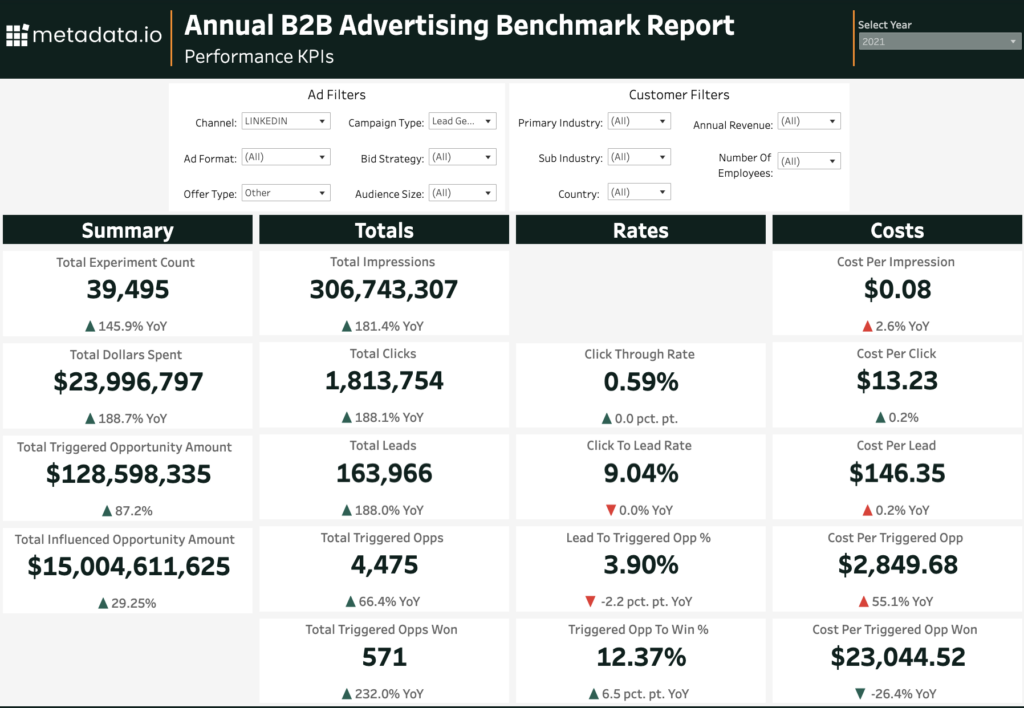

A look at how offer types perform on LinkedIn and Facebook

LinkedIn is the bad boy of B2B social media advertising and has historically outperformed Facebook in just about every way. If B2B marketers had the budget, it went to LinkedIn nine times out of ten.

There’s no denying LinkedIn’s superiority, but immediately discounting Facebook based purely on historical benchmarks would be a strategic mistake. With nearly 3B monthly active users (MAUs), Facebook’s still a monster.

Plus, someone in your target audience doesn’t morph into someone else when they log out of LinkedIn and into Facebook. A CFO on LinkedIn is still a CFO on Facebook with the same goals, challenges, and pain points.

To that end, Facebook still shines in some situations.

Let’s explore the different offer types and how they perform on both Facebook and LinkedIn:

Offer type #1: Demo

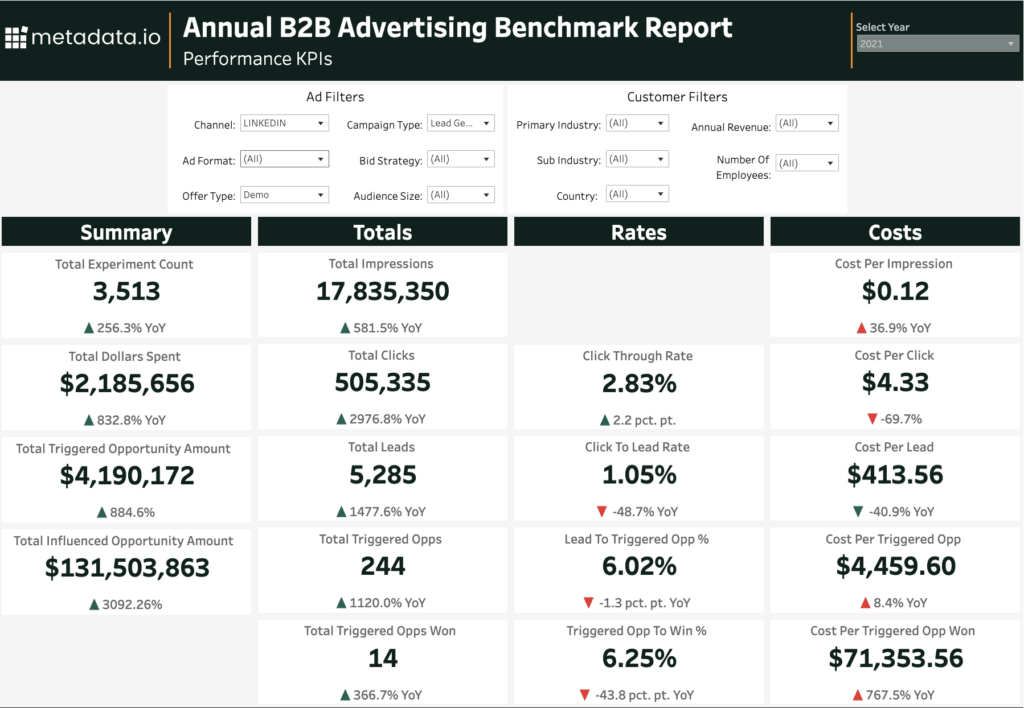

No surprise here, but when it comes to demos, LinkedIn outperforms Facebook in every way.

No surprise here, but when it comes to demos, LinkedIn outperforms Facebook in every way.

The eye test reveals that LinkedIn is, in fact, superior on this front—and pretty much every metric that matters points to that.

For starters, the CTR on LinkedIn is 4.42x that of Facebook. On the surface, that should tell you all you need to know about the mindset of people on these platforms.

While B2B buyers on LinkedIn are still B2B buyers on Facebook, the significant drop in CTR on the latter indicates that many people aren’t looking to request a demo when they’re scrolling Facebook. LinkedIn’s edge in CPC and CPL supports that as well.

This may be more than enough insight to warrant a boost to LinkedIn spending. Given the state of the economy, any chance to maximize budgets should be music to your ears.

Here’s the thing: Facebook stands out when it comes to some other key metrics.

- Facebook’s Lead to Triggered Opp %: 4.1x that of LinkedIn

- Triggered Opp to Win %: 2x that of LinkedIn

- Cost Per Triggered Opp Won: 82% lower on Facebook

Wild, right? But it makes sense.

While it’s easier and cheaper to get clicks on LinkedIn, if you can get clicks on Facebook, which is far from a given, the outcomes are better.

This also makes sense. Given Facebook’s lower CTR but impressive lower-funnel metrics, people who do request demos on the platform do so with much greater intent.

So, what’s our advice?

LinkedIn is probably where your ad dollars should go, but if you do have some budget remaining or you can stomach the higher prices, showing Facebook some love won’t hurt.

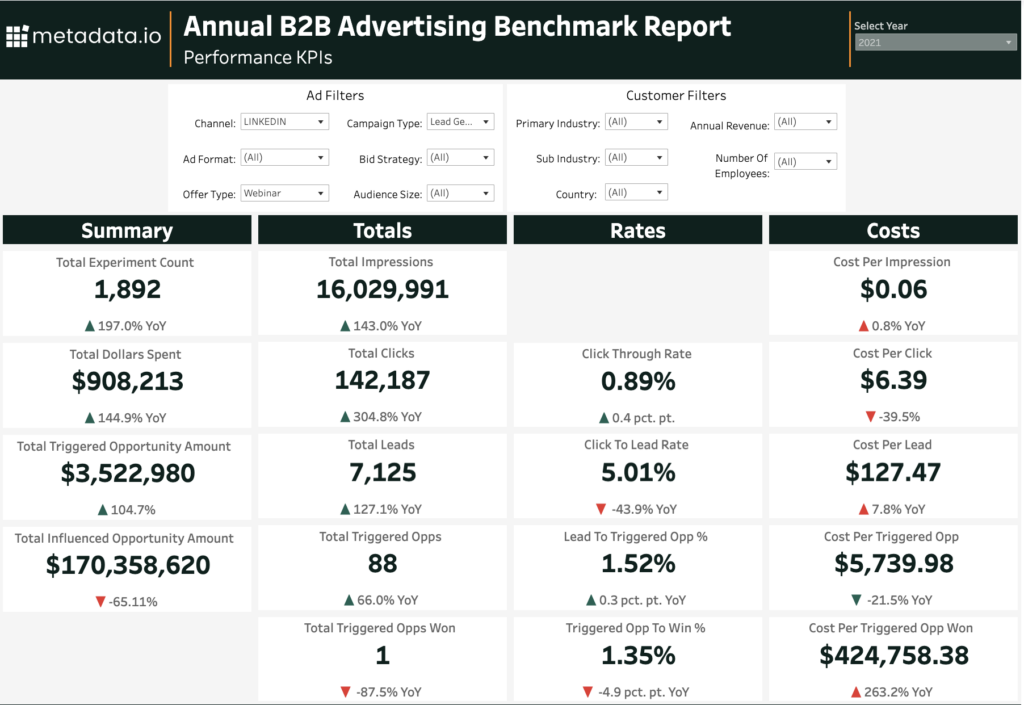

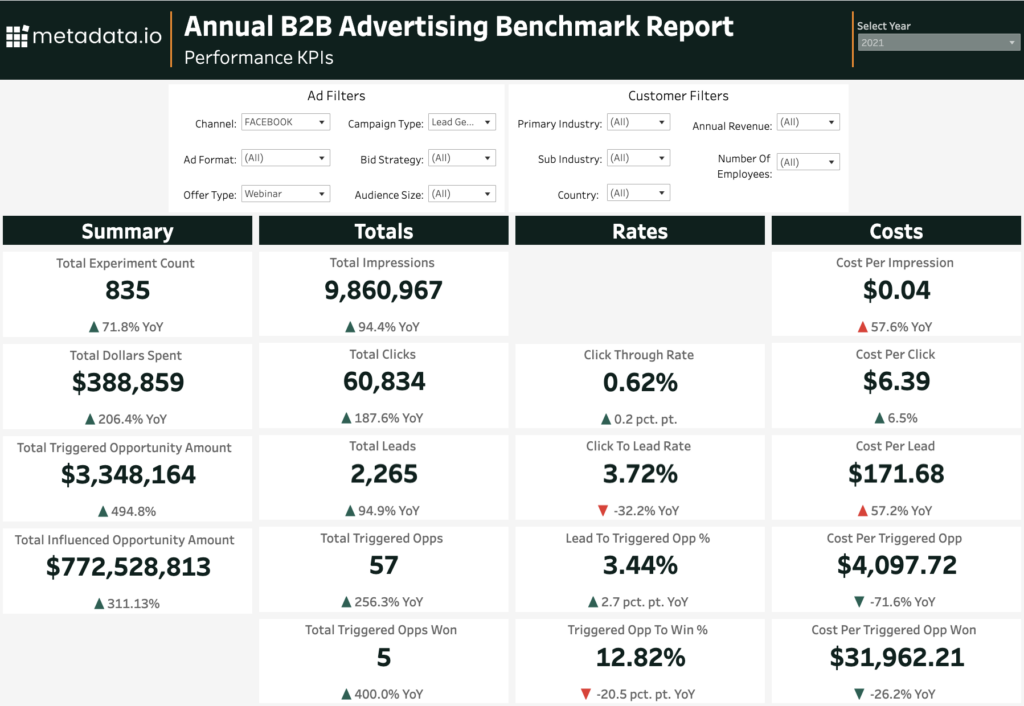

Offer type #2: Webinar

Webinars enjoyed a surge in popularity during the pandemic as B2B marketers across industry lines looked for ways to deliver value and get face time with consumers. If you’re reading this, webinars have probably been a mainstay in your recent lead-generation strategy—and you’re not alone.

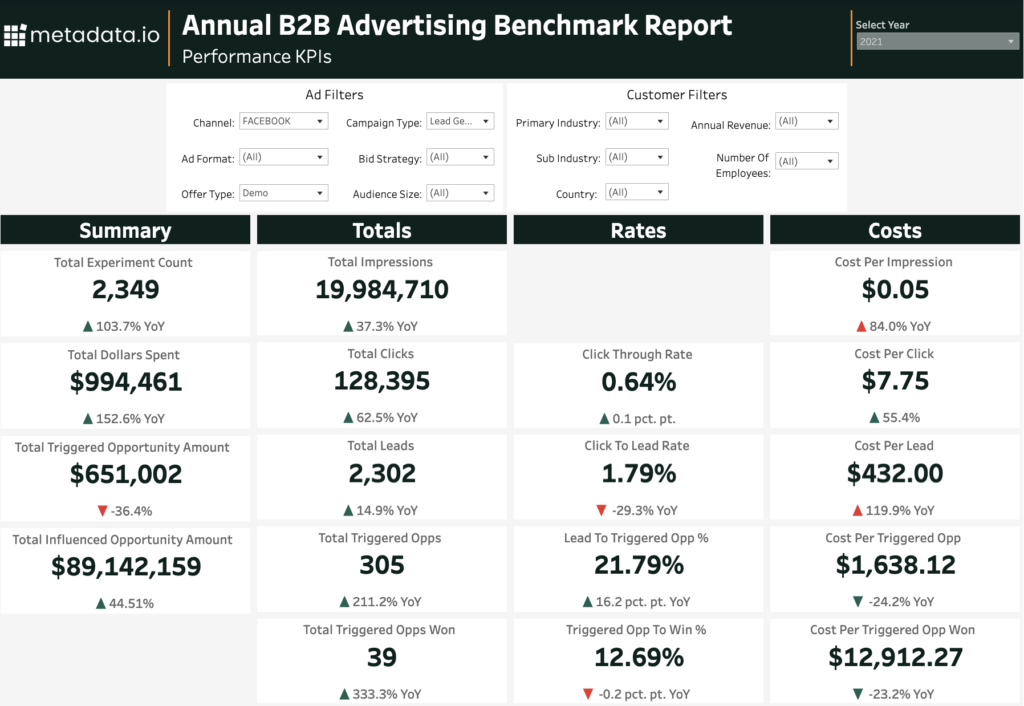

Case and point: B2B marketers spent more than $470K on ads to promote webinars in 2021.

Here’s how they performed. (Hint: It’s not a runaway race like before.)

CTR is considerably higher on LinkedIn (by the tune of 2.9x). Based on that data point and the CTRs for demos, it’s safe to say that LinkedIn should be the default choice if you’re trying to reach people in a true B2B mindset. But that’s par for the course.

That said, if you go deeper, the lines start to blur.

Facebook’s Lead to Triggered Opp % is 3.6x that of LinkedIn. At the same time, Cost Per Triggered Opp Won on Facebook was $31,962.21.

That may seem high, but LinkedIn doesn’t have a value for this metric because these ads didn’t directly drive revenue.

Is this a bit misleading given the role webinars play in lead-generation strategies? Sure.

Few marketers expect direct attribution from webinars. Still, the fact that something tangible came out of Facebook while zilch came out of LinkedIn is intriguing.

What does all of this mean?

Don’t hesitate to spread your budget across Facebook and LinkedIn. Although people are more likely to click on a LinkedIn ad that offers a webinar, the more meaningful metrics, like the ones highlighted above, indicate they’re also open to seeing webinar ads on Facebook.

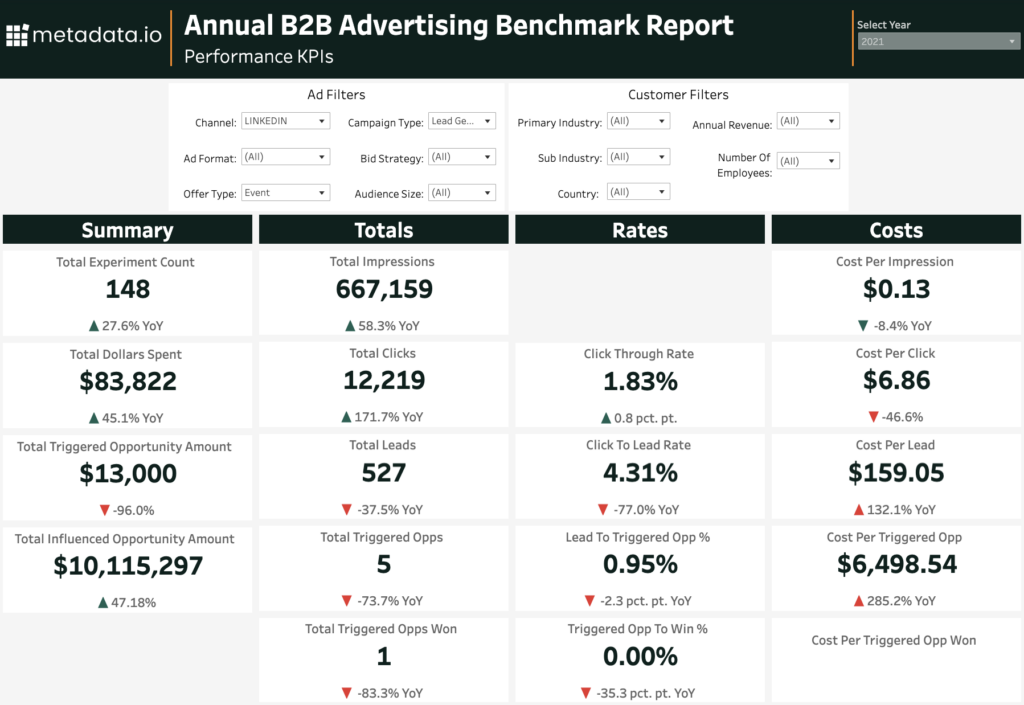

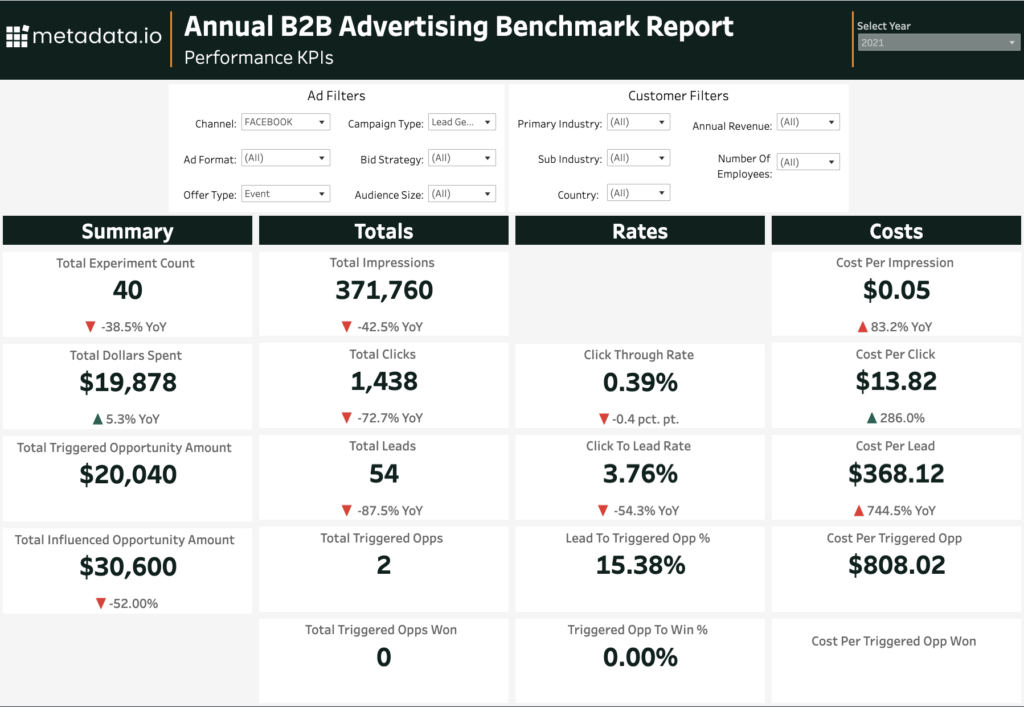

Offer type #3: Event

We’re big fans of events. So much so that we just wrapped up DEMAND 2022, the second-annual, 100%-virtual event that dove into what the best B2B marketers are doing to drive demand and revenue. (Head over to the DEMAND Content Hub to check everything out.)

The rise of virtual, hybrid and in-person events is undeniable. As pandemic restrictions fade and B2B marketers look for more authentic ways to connect with consumers, the rise will continue.

Still, events are in their infancy compared to other tactics, especially as a way to generate leads, and our data reflects that. We saw just 188 total experiments for this offer type in 2021.

There’s not much to say here other than this: LinkedIn is the obvious favorite, and it’s not even close.

Offer type #4: Other

This isn’t a “catch-all,” per se, but it is a “catch everything that’s left.” If you’re not promoting a demo, webinar or event, your campaign likely falls into the “other” offer type.

This offer type covers everything that’s not aimed at conversions—think about campaigns for brand awareness and website visits.

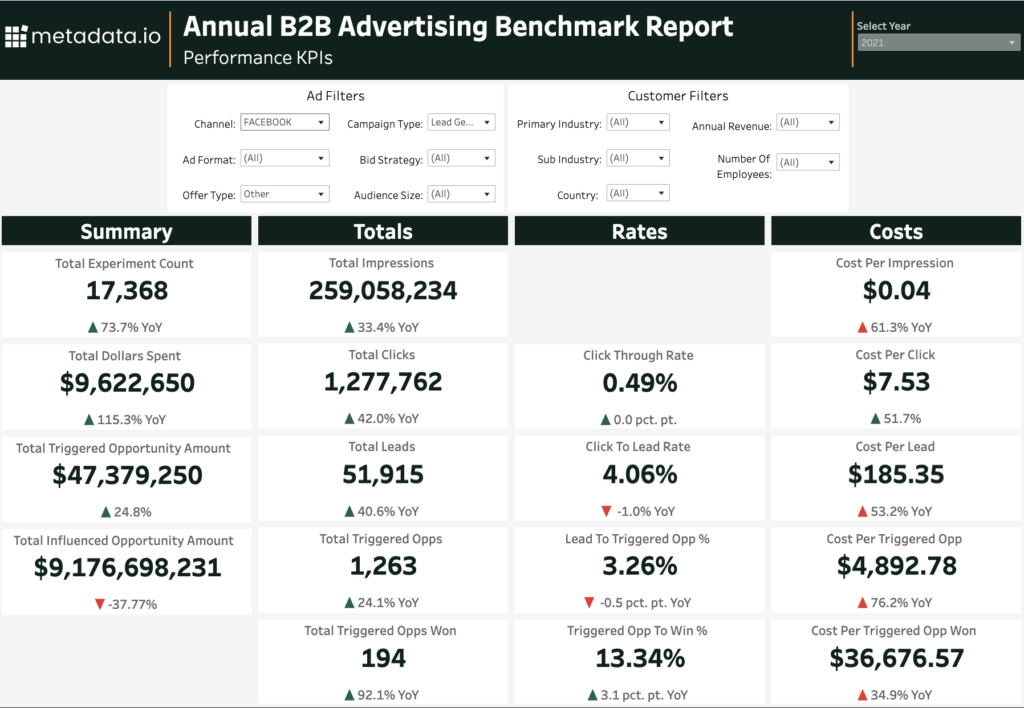

Unlike the other offer types that performed better on LinkedIn, Facebook is showing a bit of shine here, with higher-level metrics, like CTR and CPC, landing in its favor.

Facebook’s CPC is likely the first thing that caught your eye, coming in at 43% less than LinkedIn. Combine that with a lower CTR, and it’s clear that people are more receptive to B2B ads when they’re not asking for information in return.

So, from a pure brand awareness perspective, Facebook wins. With essentially the same amount of clicks for a much better price, you win, too.

As B2B marketers flock to LinkedIn, Facebook’s efficacy at the top of the funnel could provide an effective and efficient way to get in front of your audience in a way that the competition may not be considering.

Beyond that, LinkedIn still has the edge.

LinkedIn’s CPL is 21% lower than Facebook’s. At the same time, LinkedIn drove a Cost Per Triggered Opp Won 37% lower than Facebook.

What to take away from this benchmark report

Ok, that was a lot, but hopefully, it gave you the insight you need to make smart decisions on LinkedIn and Facebook offer types.

Before we go, let’s zoom out and highlight the key points to keep in mind when crafting your demand generation strategy in 2023:

- Overall, conversion ads, e.g., demos, webinars, and events, perform better on LinkedIn. That said, if you can generate clicks on Facebook via great creative and copy, the outcomes may be worth it (but they’ll be expensive).

- Brand awareness, engagement, downloads and other “lighter-touch” ads do well on Facebook. This is the one situation that brings performance parity between the platforms into play.

- Facebook isn’t where lead-generation strategies go to die.

Let’s address #3.

While there’s no denying LinkedIn’s superiority in the B2B world, Facebook’s strong underlying metrics point to the fact that people don’t mind B2B ads delivered here.

Are they less likely to click? Absolutely. Most people scrolling through Facebook aren’t ready to call it official with a B2B brand.

Facebook can hold its weight, and although it’s not the B2B playground that LinkedIn is, it can still act as a powerful lever to drive leads, pipeline and ROI in 2023.