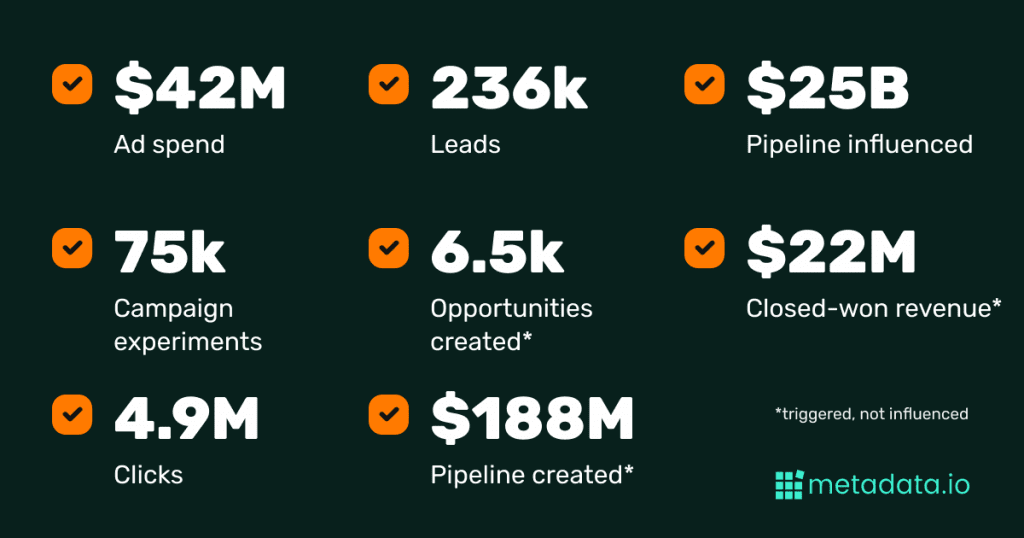

2022 B2B Paid Social Benchmarks: What We Learned From $42M in Spend on Facebook and LinkedIn

Running good paid social ad campaigns isn’t just a switch you can flip. Well, you could, but you’re going to burn a lot of your marketing budget.

It’s all about finding the sweet spot of the right audience, right channel, right ad, and the right offer. With this combination, there really isn’t a better advertising medium for demand generation marketers.

This B2B Paid Social Benchmark Report will give you the data you need so you can run better paid social campaigns in 2022 and beyond.

- How to look at the data

- LinkedIn vs. Facebook for demand gen marketers

- What are the best CTAs?

- How long should your ad text be?

- What works better: images or videos?

- Which images work best?

- LinkedIn Conversation Ads

- How to set your own benchmarks

Before we get any further

How attribution works in Metadata

Let’s talk real quick about every demand gen marketer’s favorite topic: attribution.

No “account-based marketing platform” connects campaigns to revenue. Any attribution is generous and always overinflated. Connecting display impressions to pipeline is a huge stretch. Your CFO won’t take you seriously if you’re hanging your hat on influenced pipeline, we promise.

Attribution in the Metadata platform is strict (like real strict). Our primary attribution model only takes credit for opportunities that meet three criteria:

- A lead was generated from a Metadata campaign

- The converted Metadata lead is a contact associated with an opportunity

- The converted Metadata lead was created before the opportunity was created

Most of our customers set a custom date range requiring the opportunity to be created within 90-180 days of lead conversion.

Pipeline and revenue metrics are underreported in this report (and here’s why)

Our customers need to have Metadata connected with Salesforce in order for us to track opportunities, pipeline, and revenue.

We have customers who don’t connect Salesforce with Metadata (or don’t use Salesforce at all). So their ad spend and performance metrics are included here, but we’re missing their opportunity data.

Keep this in mind as you’re reading the rest of the report and using the Tableau dashboard.

Also ~10% of total ad spend is from brand awareness campaigns that only optimize to CTR. So they don’t track leads, opportunities or pipeline.

So, what’s working in paid social for demand gen marketers?

We analyzed actual campaign data from every experiment Metadata customers ran in 2021 to find legit paid social media benchmarks you’ve been looking for.

We looked at every data point we have access to. From spend and impressions to clicks and leads to MQLs—all the way down to opportunities and closed-won revenue.

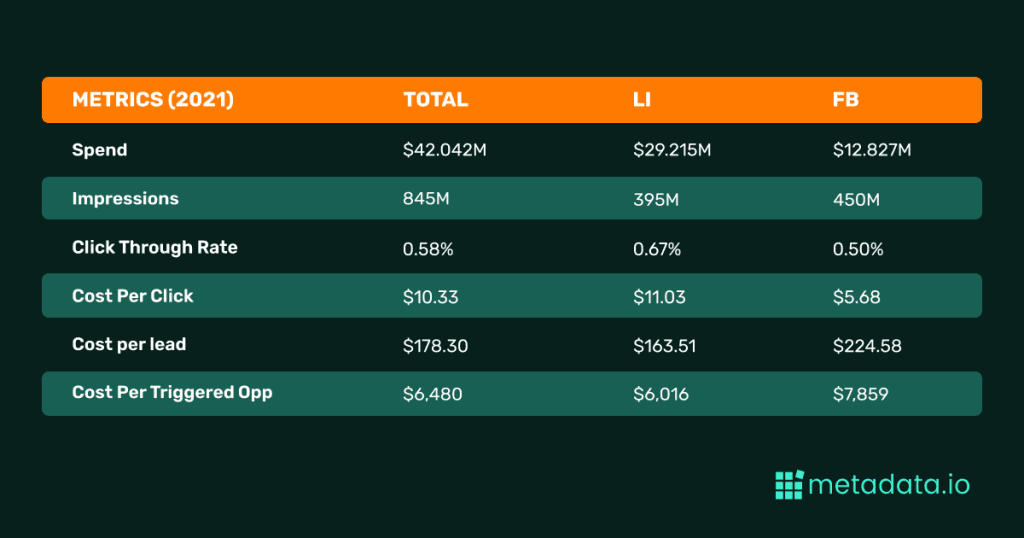

We analyzed nearly $42M in ad spend and we’ve zeroed in on how our customers are running better campaigns on Facebook and LinkedIn.

The benchmarks and insights in this report are based on straight-up averages across all Metadata customers. But we’re giving you the raw data to slice and dice however you’d like—by industry, annual ad spend, and company size.

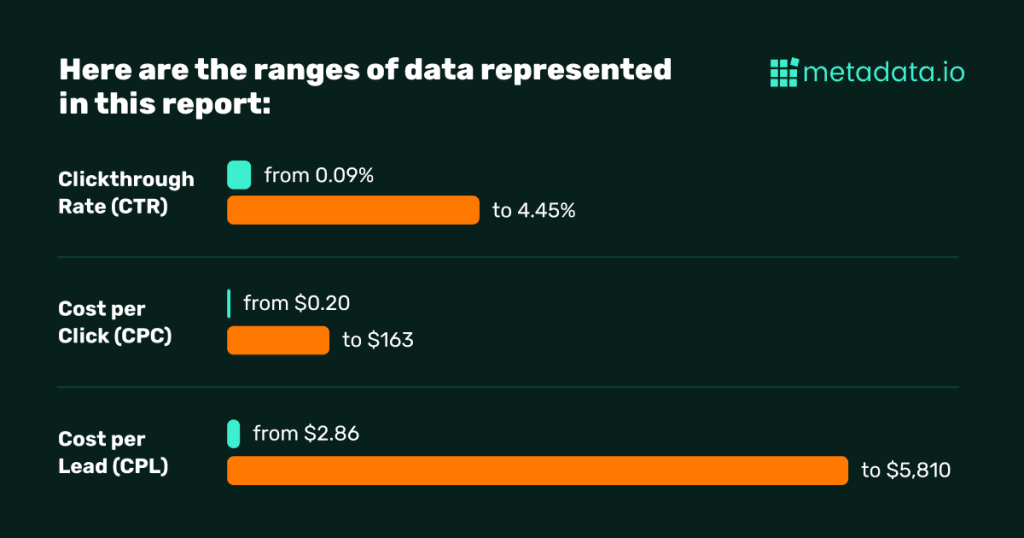

As you can see, there’s a huge range from the lowest to highest values in CTR, CPC, and CPL.

Our customers are spread across different industries, from software to manufacturing to services—each with its own demand model.

A $3 CPC may be realistic for a company selling task management software on a self-serve, $8/month basis but not for an enterprise data platform with a $180k ACV.

And a cheaper SaaS product might be able to pay a few bucks for a lead, while a six-figure data platform would expect upwards of $5k per lead as they target VPs and CTOs.

Download the report

Get your own PDF copy of the B2B paid social benchmarks report.

How to look at the data

- Click-through rate (CTR): CTR is an early indicator of how appealing and relevant your target audience finds your campaign. It’s best to look at this when you’re experimenting with several ads, creative, etc., and want to quickly optimize those with the most initial engagement. A CTR of 0.60% to 1% is considered good.

- Cost per click (CPC): CPC is another early indicator of efficiency, and you can use it to compare one campaign against another. You’ll optimize to this metric if you’re running a brand campaign, while you’ll optimize to CPL for lead gen. What we consider to be a good CPC is relative, but for good paid social campaigns with relevant offers, it should be below $10.

- Cost per lead (CPL): CPL measures the efficiency of your campaign. How much can you spend to generate a qualified lead and convert that lead to a customer? A good CPL is different for every company and should be based on your unit economics. For example, if my average selling price is $1M vs. $100k, I can likely afford to spend more per lead.

- Cost per opportunity (CPO): CPO is another measure of efficiency you can use to start looking at ROI from your marketing. You’ll have a good sense of ROI if you know the opportunity dollar value and your cost per opportunity. A good CPO is different for every company and should be based on your unit economics.

- Channels: We’re reporting on PPC ads displayed on both LinkedIn and Facebook, two of the most popular paid channels for demand gen marketers. We’ve also pulled out specific data on LinkedIn Conversation Ads, since the metrics pan out a bit differently than display ads.

LinkedIn vs. Facebook

We already know what you’re thinking. We hear it all the time. My audience isn’t on Facebook.

But your customers don’t build walls around their professional and personal lives. You have to meet them where they are.

With more than 2 billion users worldwide, including 74% in the US who log in daily, Facebook could potentially get a boat-load of high-quality, high-earning eyeballs on your B2B campaigns—if you can target them.

You need to be aware of the differences between running ads on Facebook and LinkedIn because it should impact how you plan your next campaigns.

Key differences

Although the averages may tilt to one platform—there are legit reasons to run campaigns on both Facebook and LinkedIn. It depends on who you are, who your audience is, and the types of campaigns you run.

Impressions

You can’t measure the success of your campaign based on impressions. One thing is still worth calling out though: advertisers received 55M more impressions on Facebook than on LinkedIn with less than half the spend.

The data shows a higher CPL and CPO for Facebook than for LinkedIn—but it also means that Facebook may still be an underutilized channel for demand gen marketers.

Cost

In the past, CPLs have been lower on Facebook than on LinkedIn—but that wasn’t the case in 2021. The CPC is lower on Facebook, but costs (per lead and opportunity) are at least 30% higher than on LinkedIn.

But these stats don’t differentiate between retargeting campaigns that leverage custom audiences. Some advertisers may see lower CPLs on Facebook because they’re targeting contacts who’ve already engaged with them in some way.

Lead quality

We don’t see a big difference between LinkedIn and Facebook regarding lead quality. LinkedIn gets a 2.72% conversion rate from lead to opportunity, while Facebook gets 2.86%.

Incoming pitch slap – this is because of how we build audiences on Facebook and LinkedIn using our own platform.

We can use standard firmographic and job title targeting across LinkedIn and Facebook, targeting the same people without using lookalike audiences or personal-interest targeting. The type of targeting each channel suggests you use and sucks up the rest of your budget.

What are the best calls to action?

What do you want your audience to do when they see your ad?

The answer to this question—your call to action (CTA)—is one of the most critical parts of any ad. It’s also one of the easiest things to experiment with. You can clone an entire campaign and change the CTA to see which campaign drives more (or better) conversions.

So test multiple CTAs in your campaigns early on so you can see which brings the highest CTR or lowest CPC, then use that one going forward.

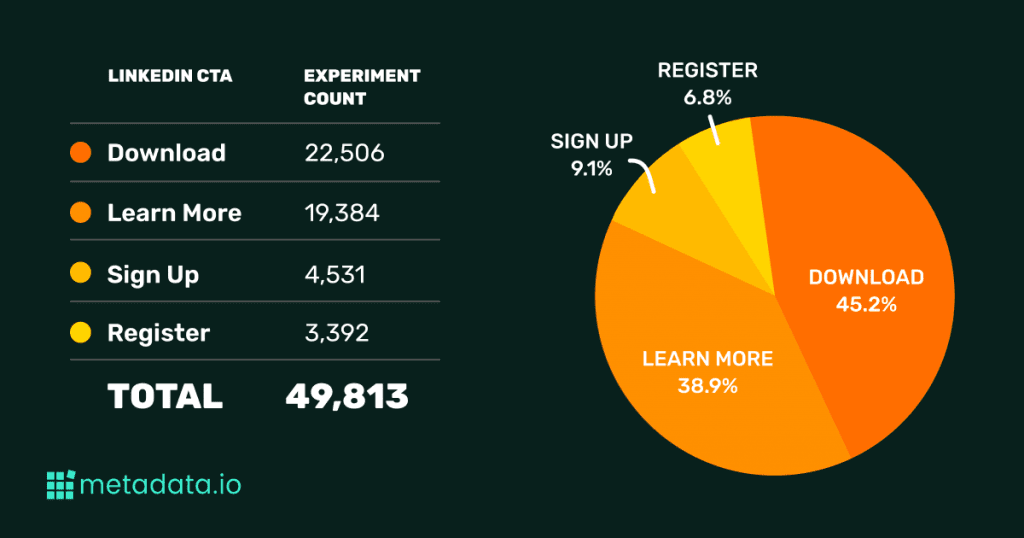

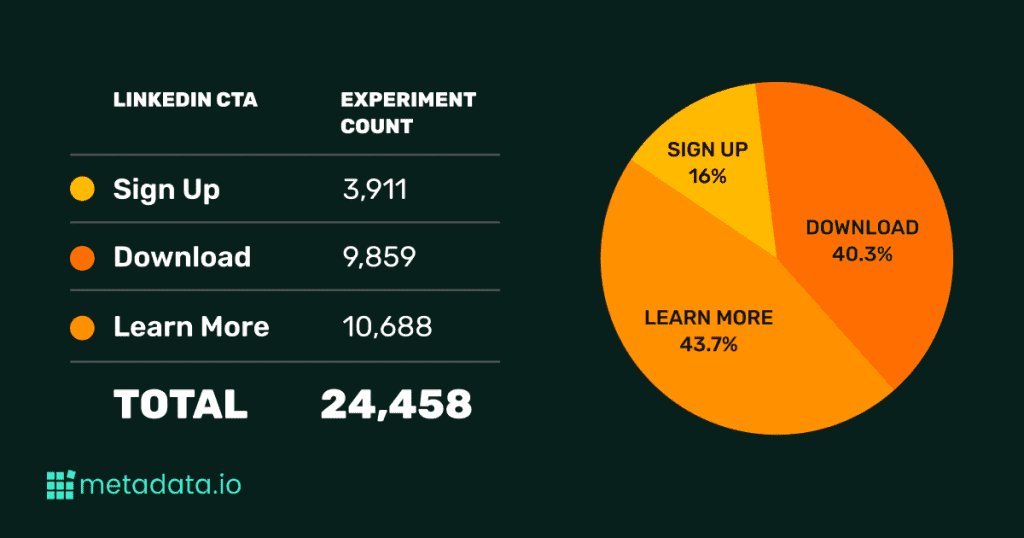

On LinkedIn: “Download” takes the cake

Most used CTAs on LinkedIn

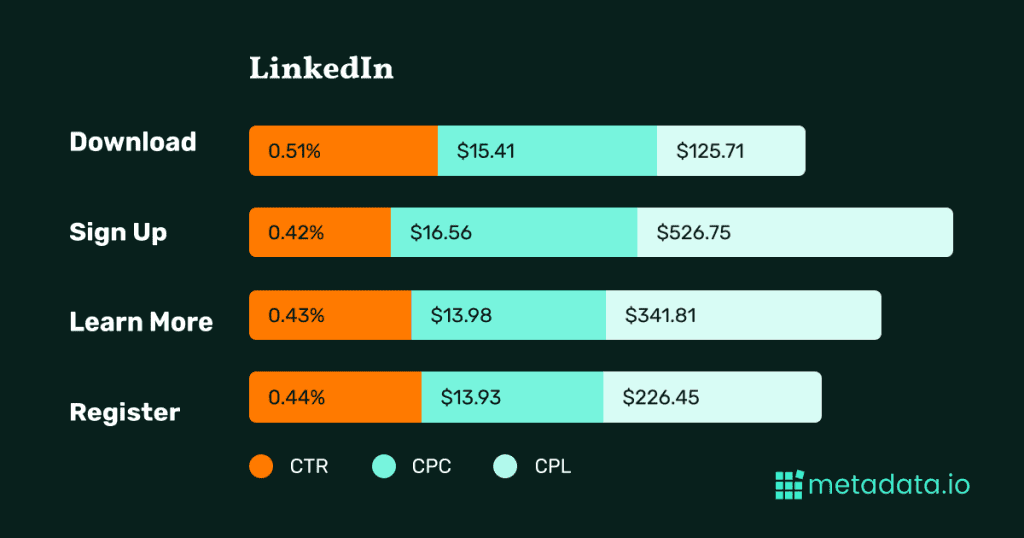

Nearly half of our customers used “Download” as their CTA of choice on LinkedIn—and for good reason. While “Learn More” had a lower CPC, making it an attractive option for demand gen marketers on tight budgets, “Download” boasted the highest CTR.

More importantly, experiments that used “Download” over other CTAs saw a much lower CPL: $125.71.

On the other end of the spectrum, “Sign Up” doesn’t look like a good option when running campaigns on LinkedIn: the CTA has the lowest CTR and the highest cost, both per click and per lead.

Most used CTA for lead gen

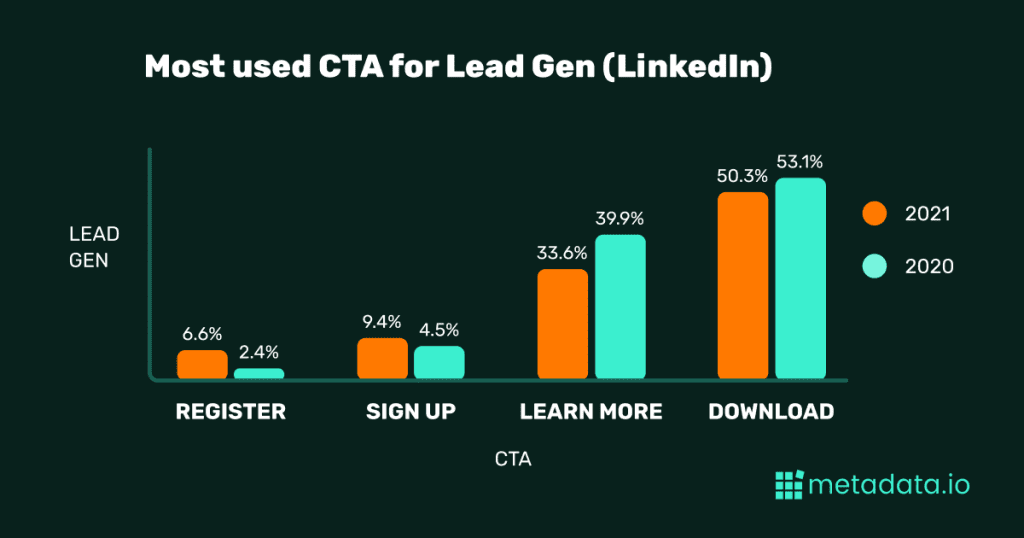

“Download” still holds its spot as the most popular CTA for lead gen campaigns, taking up an even larger share than last year. While “Register” isn’t nearly as popular, its wider usage in 2021 points to the increased use of webinars in 2021 for lead gen efforts.

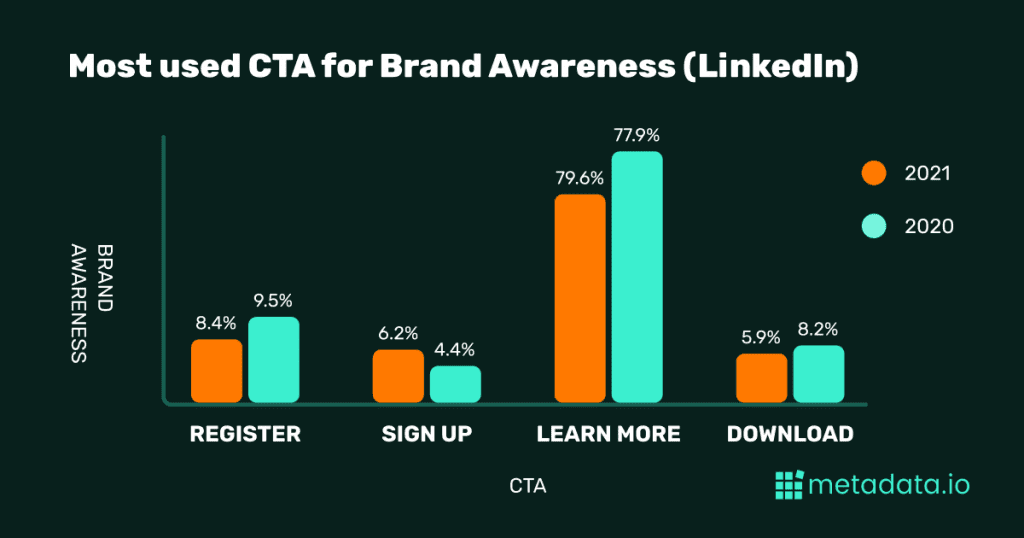

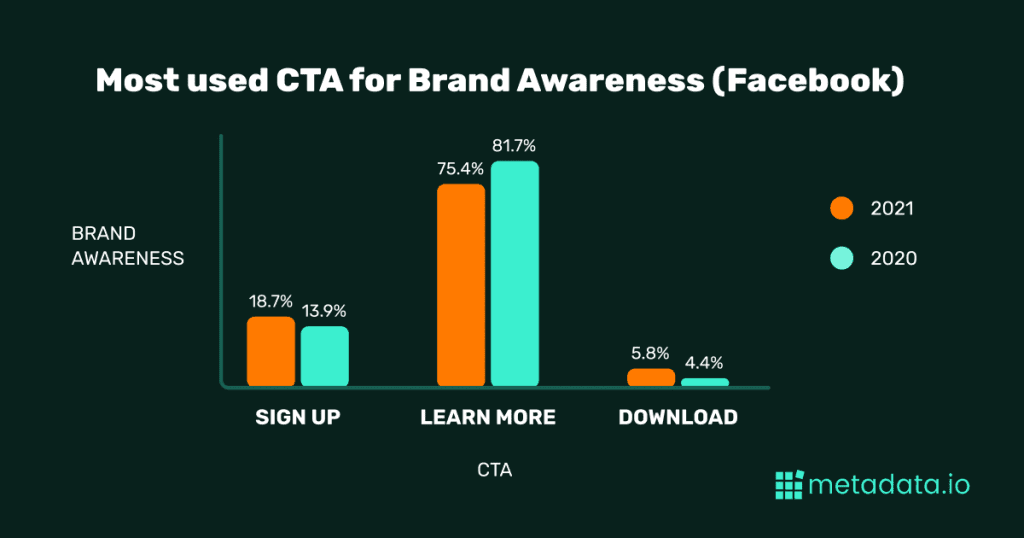

Most used CTA for brand awareness

“Learn More” is still by far the most popular CTA for brand awareness on LinkedIn—despite the fact that “Download” has the highest CTR. When using the softer CTA, marketers are likely less concerned with driving immediate leads. They’re more focused on getting their message and content consumed.

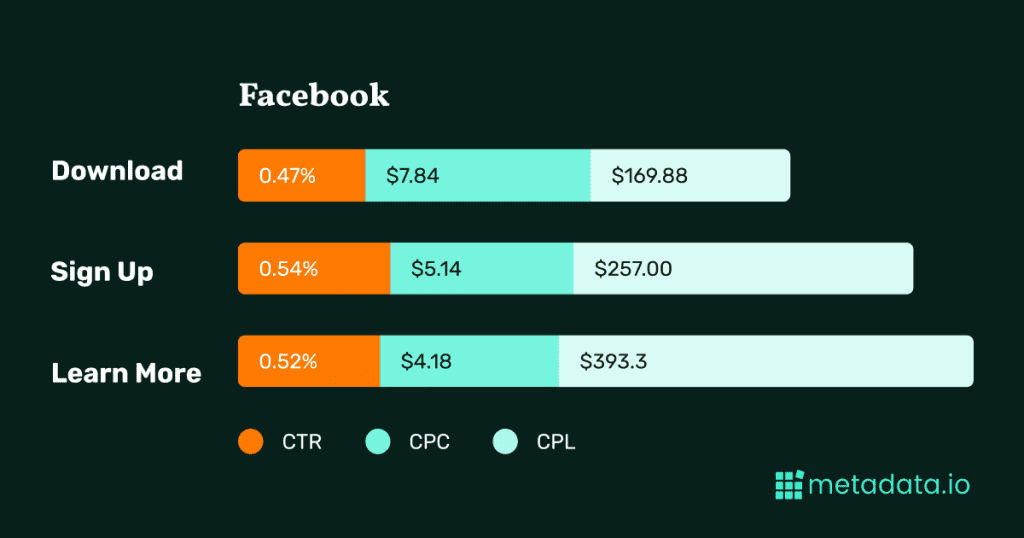

On Facebook: “Learn More” is more popular, but “Download” has the lowest CPL

Most used CTAs on Facebook

Our customers most commonly leaned on the “Learn More” for Facebook, most likely because it has the lowest CPC of the three available CTAs.

At the same time, “Download” was the second most popular option for a more important reason: it had the lowest CPL, by far.

This makes “Download” a good option for CTAs on both LinkedIn and Facebook. And, while it’s not in these tables, the click-to-lead rate for “Download” was roughly double the next-best option on both platforms (12.26% on LinkedIn and 4.61% on Facebook).

Big picture, we recommend constantly testing both “Download” and “Learn More” for both platforms, while mixing up your ad copy and images.

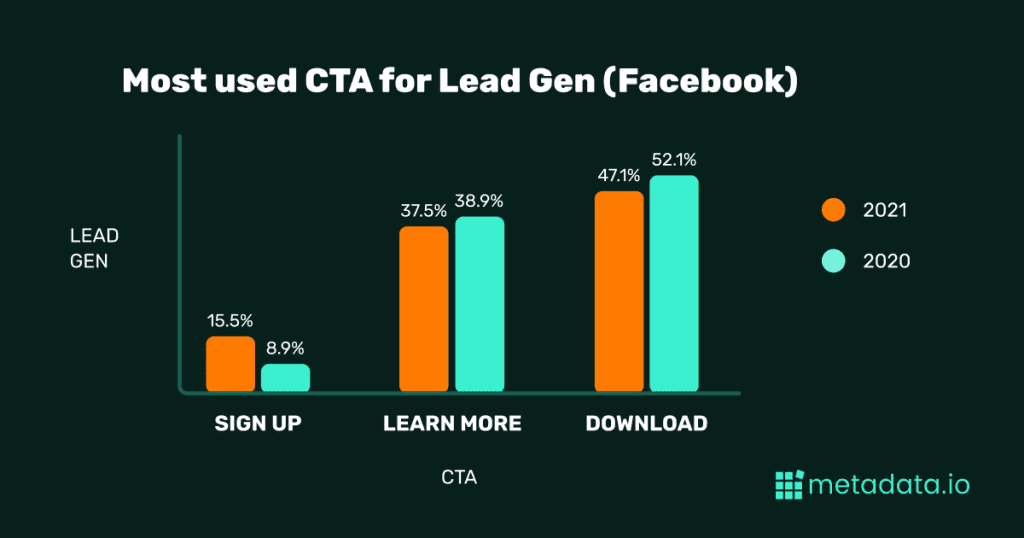

Most used CTA for lead gen on Facebook

Content is still king on Facebook, with “Download” taking up nearly half of the CTAs for lead gen on the platform. “Sign Up” became more popular in 2021, likely as a means of promoting freemium tools and free trials.

Most used CTA for brand awareness on Facebook

Marketers lean on “Learn More” most of the time for brand awareness campaigns on Facebook—after all, it has the lowest CPC for campaigns typically aimed at larger audiences.

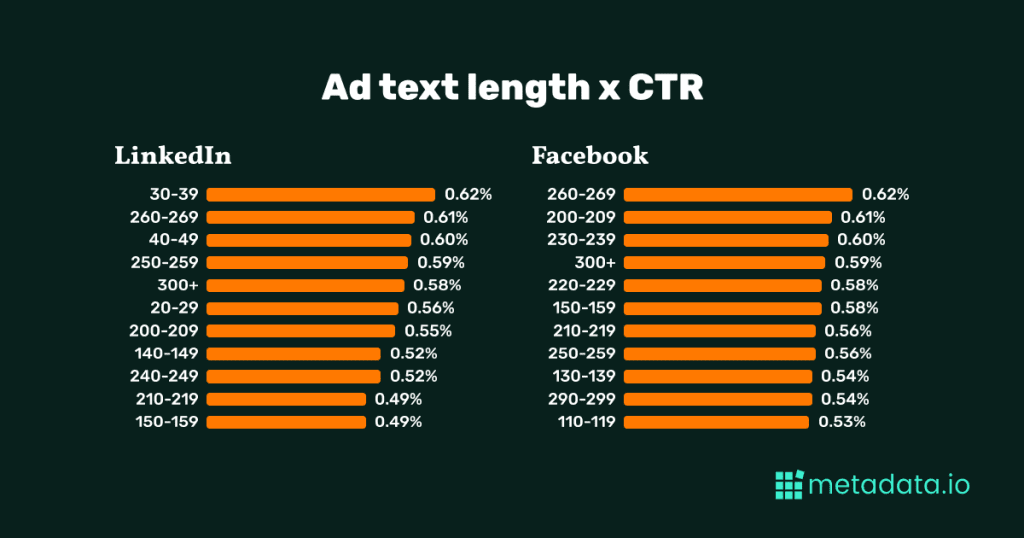

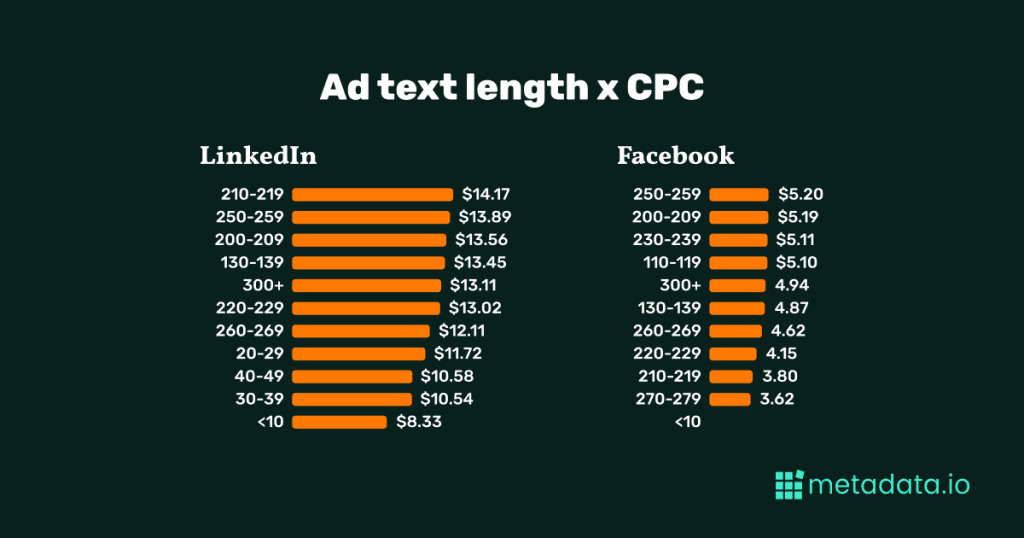

How long should your ad text be?

The clearest trend in ad text length is that ads perform better on LinkedIn with short text, while ads on Facebook perform better with longer text.

In terms of popularity, B2B advertisers on both LinkedIn and Facebook steered toward middle options—the largest percentage of ads had word counts in the range of 80-130. But, from a performance perspective, that range doesn’t perform nearly as well as the lower end for LinkedIn and the higher end for Facebook.

Here’s how ad text length differs depending on CTR and CPC.

Ad text length x CTR

Ad text length x CPC

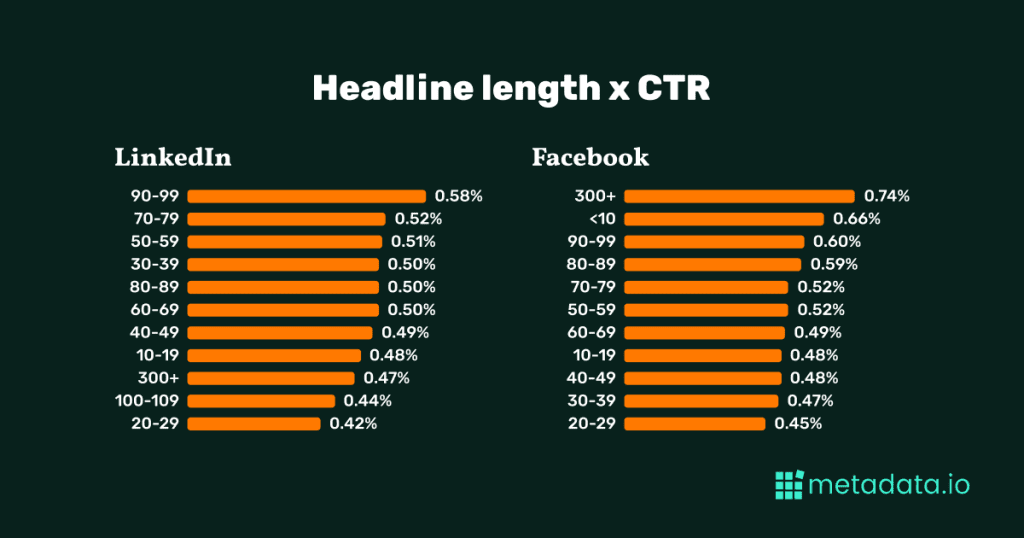

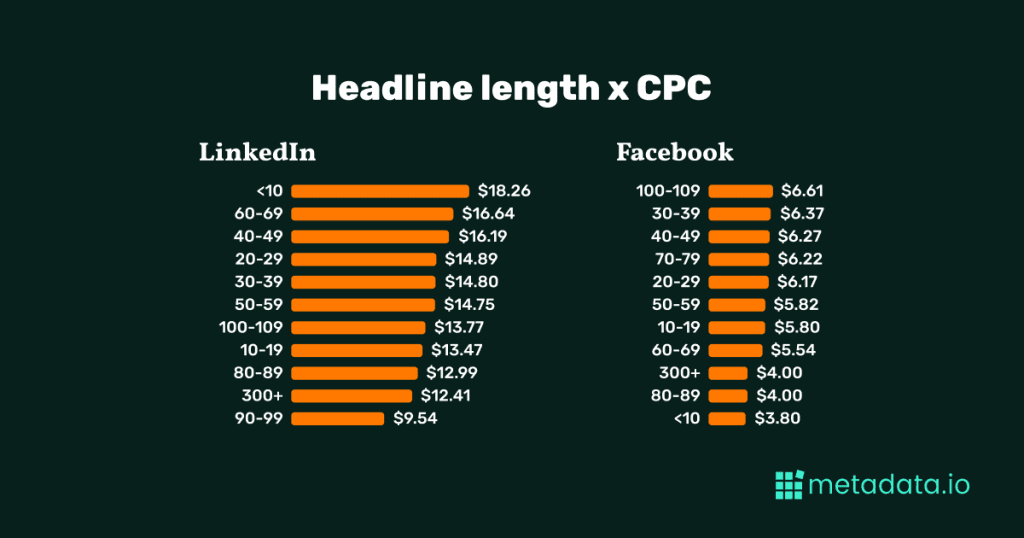

How long should your ad headline be?

Most brands err on the side of making their ad headline shorter—roughly half of the ads placed on both LinkedIn and Facebook sported headlines of fewer than 39 characters.

Given conventional marketing wisdom, it makes sense; short attention spans and all that.

But longer ad headlines perform better from a performance perspective: CTR is higher for longer headlines, and CPCs are lower. (For the most part—it’s not quite right to say the longer the headline, the better the performance.)

See for yourself:

Headline length x CTR

Headline length x CPC

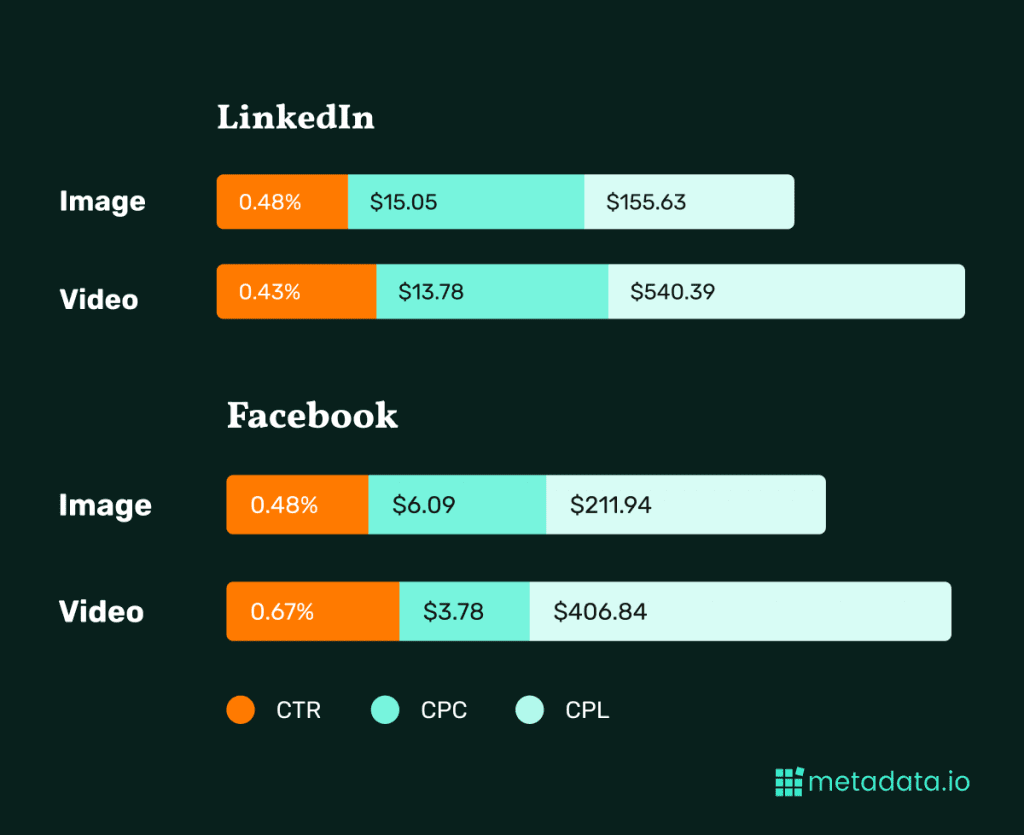

Images vs. videos

While the CTR for video ads is slightly higher than image ads (on both LinkedIn and Facebook), by most other metrics, images outperform videos for our customers.

For whatever reason, the lead conversion rate on video ads is much lower than for image ads, translating into much higher CPLs for video.

Add in the higher cost of production, and it becomes hard to justify the effort behind video ads when compared to image ads and Conversation Ads.

Which images work best?

We looked at which images performed best and found that ads with high click-through and low cost per lead had a few things in common:

- They drive curiosity

- They use photos of REAL people

- They use stats to back up their point

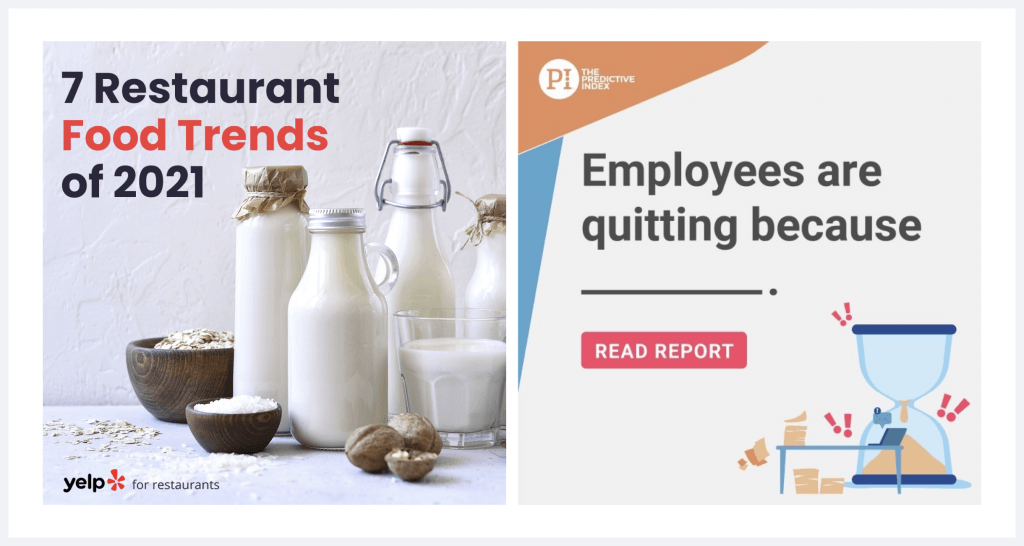

Drive curiosity

Driving curiosity in your creative is the name of the game. You can tease out your content (gated for lead gen, ungated for brand awareness) in the ad text, but the image will catch the eye.

For example, these ad images (from Yelp and The Predictive Index) each got more impressions, higher click through, and a much lower CPC than average.

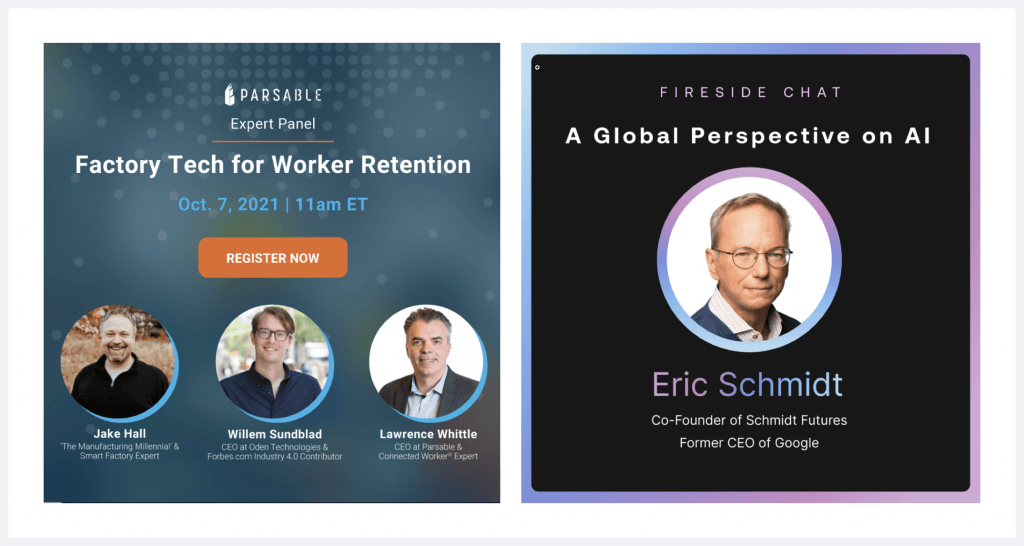

Use photos of REAL people

The next thing we noticed about the ads that did well was that they featured pictures of real people in their creative.

Stock images don’t perform as well as real photos because they feel impersonal. Some of the top ads featured a headshot of the subject matter expert in the ad.

Use stats to back up your point

People are more likely to believe something if you have evidence to back it up – especially in an ad. So, it makes sense the ads that used stats in their creative were some of the most effective.

How do offer, audience, and bid type impact ad metrics?

Your ad CTAs, creative, and copy aren’t the only factors that will influence your metrics. Let’s take a look at:

- Offer type

- Audience size

- Bid type

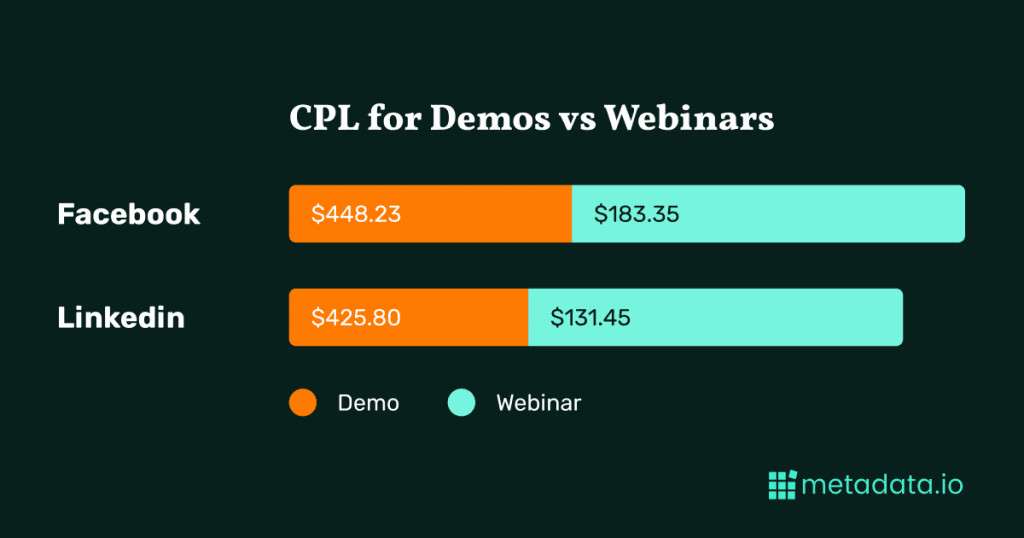

Offer type: Demos vs. webinars

Unsurprisingly, CPLs for demo ads are much higher than webinar ads—roughly three times the cost on LinkedIn and 2.5x the cost on Facebook.

This flows through to CPO: opportunities triggered by webinar leads are more expensive than those triggered by demo requests on both channels.

Audience size: MetaMatch made in heaven

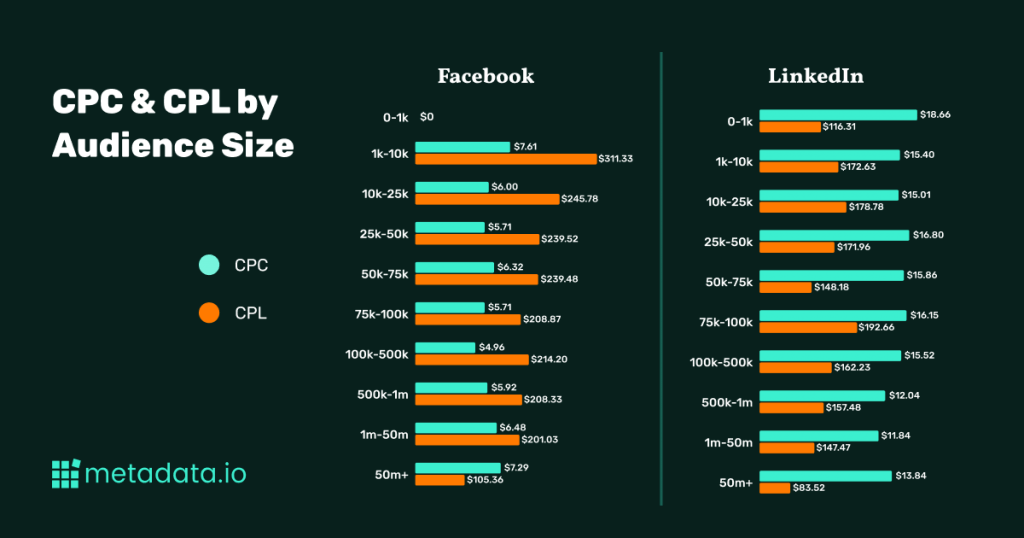

It’s nearly conventional wisdom at this point: the smaller the audience, the higher the CPC.

But, on LinkedIn at least, it’s better to track the cost farther down the funnel: the smallest audience size (1-1,000) saw the lowest CPL out of any audience size.

Another incoming pitch slap: one reason our customers see success here is because they build audiences using MetaMatch, our patented personal-to-corporate identity graph.

MetaMatch allows you to build laser-focused audiences on Facebook and LinkedIn. We match based on email addresses, not cookies or IP addresses. You can match personal emails to legit business emails with our proprietary database of 1.5 billion (with a b) B2B profiles. Metadata customers typically see match rates between 15-45% on Facebook and 60-75% on LinkedIn.

On Facebook, the best results are seen with medium-sized audiences (for example, we see low CPC and relatively low CPL in the 500k-1M range).

Long story, short: if you’re looking to optimize by CPC, go with the 100k-1M range on either platform. But we recommend getting a little more granular than that.

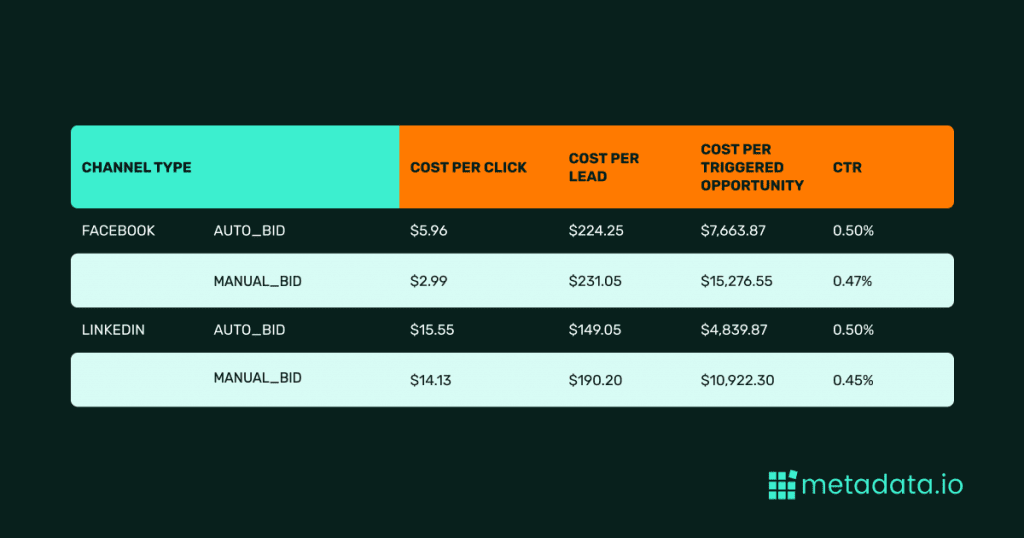

Bid type: Automated bidding is where it’s at

Speaking of tracking campaign performance further down the funnel: Metadata’s automated bidding on both LinkedIn and Facebook outperforms manual bidding where it matters most.

The automated bidding feature leverages the channel’s native algorithms to bid on ad placements that are more likely to meet your goals efficiently.

While the CPC is roughly twice as expensive, everything from click-to-lead rate to CPO is better when you use automated bidding instead of manual bidding.

Check it out.

Campaign effectiveness is better with automated bidding

Here’s the headline: you might pay 2x per click with automated bidding, but down-funnel you’re paying half the cost per opportunity. That’s a few dollars versus a few thousand dollars.

Automate Campaigns

Forget about manual and repetitive work. Now you can focus on the big things like strategy and creative.

How LinkedIn Conversation Ads perform

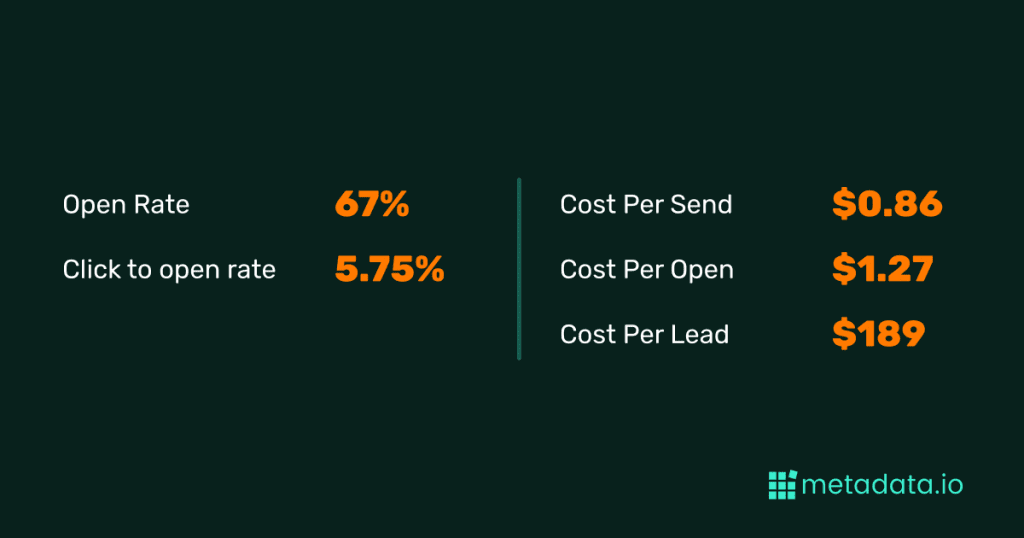

In 2021, Metadata customers spent just over $2M on LinkedIn Conversation Ads—and saw a high degree of success.

With open rates that far exceed email and a relatively low CPL, Metadata users are realizing that Conversation Ads make demand gen both scalable and personal.

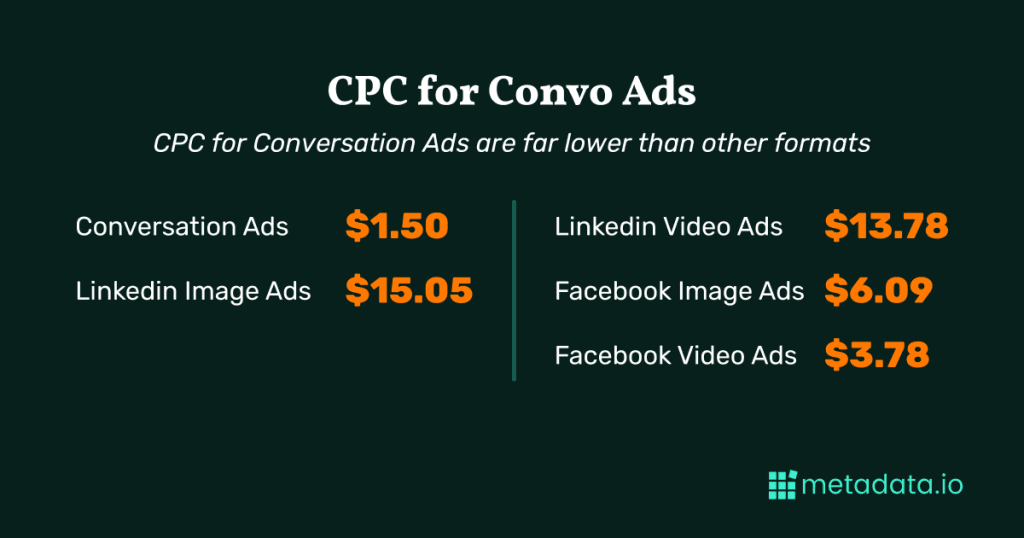

CPC for Conversation Ads

Because LinkedIn Conversation Ads use a bidding model (per send) instead of a CPC or CPM model, the CPC are far lower than what we see for LinkedIn sponsored content or in the Facebook newsfeed.

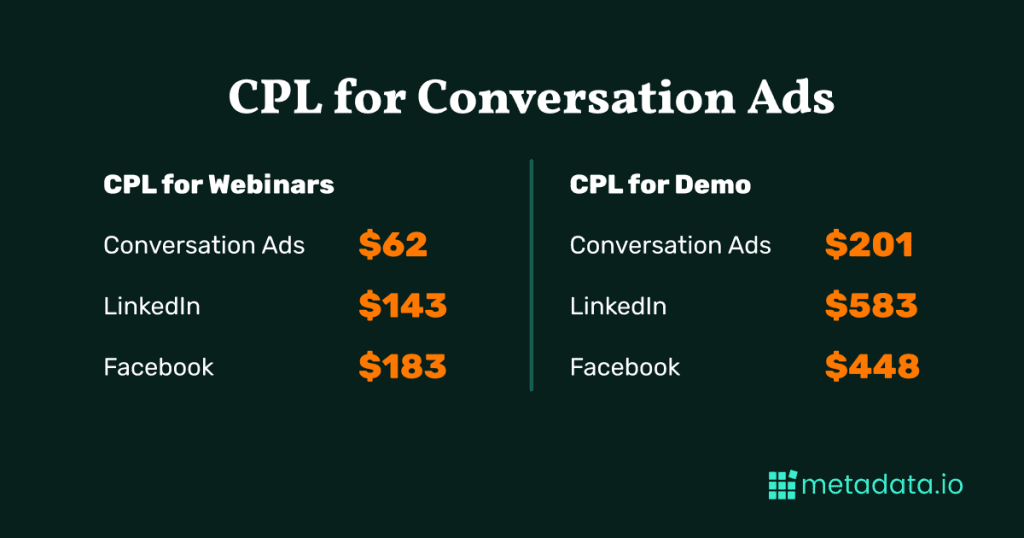

CPLs and CPOs for LinkedIn Conversation Ads

The low CPC for LinkedIn Conversation Ads—combined with the personal touch provided in the message itself—translate into much lower CPLs and CPOs, too.

The lower cost holds true for both messages promoting webinars and those pointing to a demo.

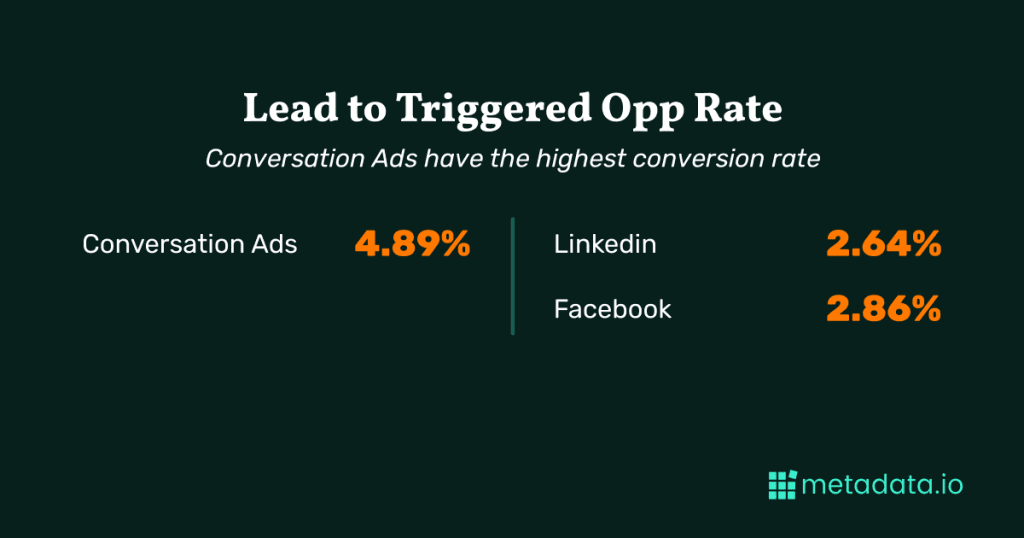

Conversion Rate for LinkedIn Conversation Ads

LinkedIn Conversation Ads aren’t just budget-friendly—they’re also highly effective.

They combine the scale and targeting of paid social with a chatbot-like experience. They come from a person, not a company, which makes the content feel less like an ad and more like a personal message.

The result is a high conversion rate from lead to opportunity.

This is good news for every demand gen marketer who needs to generate qualified demos that convert to revenue.

But the high conversion rate has a flipside: each person who receives one of these ads (Conversation Ad or InMail) can only receive one message from any one advertiser every thirty days. While Conversation Ads saw the lowest CPCs, CPLs, and CPOs, this 30-day limitation makes it a harder-to-scale tactic.

Never fear: our data also shows that when someone sees a LinkedIn ad from the same advertiser they receive a Conversation Ad from, open rates increase by 8%, and click to open rates increase by 22%.

LinkedIn Conversation Ads should be part of your strategy—not your entire strategy.

Best practices for LinkedIn Conversation Ads

We can’t write your copy for you, but we’ll share what we’ve seen work based on actual data:

- Have fun with it. Conversation Ads that used emojis saw a 23% boost to the CTR and an 8% increase in the conversion rate.

- Call me, maybe? When Conversation Ads included a “Maybe? Tell Me More” button, 28% of recipients click it—and 43% of those that clicked turned into leads. Without that button, all those leads would be lost.

- Two’s a company, three’s a crowd. Conversation Ads that included two CTA buttons saw a higher click-to-open rate than those with just one (6.15% compared to 5.21%). But messages with three buttons saw a lower click-to-open rate: just 4.63%.

How to set your own benchmarks

We’ve shared a lot of data here.

Like we said up-front, this data looks at averages across all of our customers, but we’re also giving you access to the actual raw data—so you can dig in and pull insights that are most relevant to your business.

Watch the walkthrough video

If you’re reading this on your phone, the Tableau dashboard won’t render well. View the dashboard on your computer so it looks pretty.

Please check back often as we are continuing to add more features and data to this dashboard.

Wrapping up

“What works” is changing faster than ever. The campaign that failed three weeks ago may work today. The evergreen campaign that’s worked for two years could stop working next week.

As demand gen marketers – we’re constantly testing, refining, testing some more.

And while the data we shared in this report focuses on top-of-funnel metrics like CTR, CPC and CPL, you also have to look at lower-funnel performance and connect the dots to real ROI: pipeline and revenue generated.